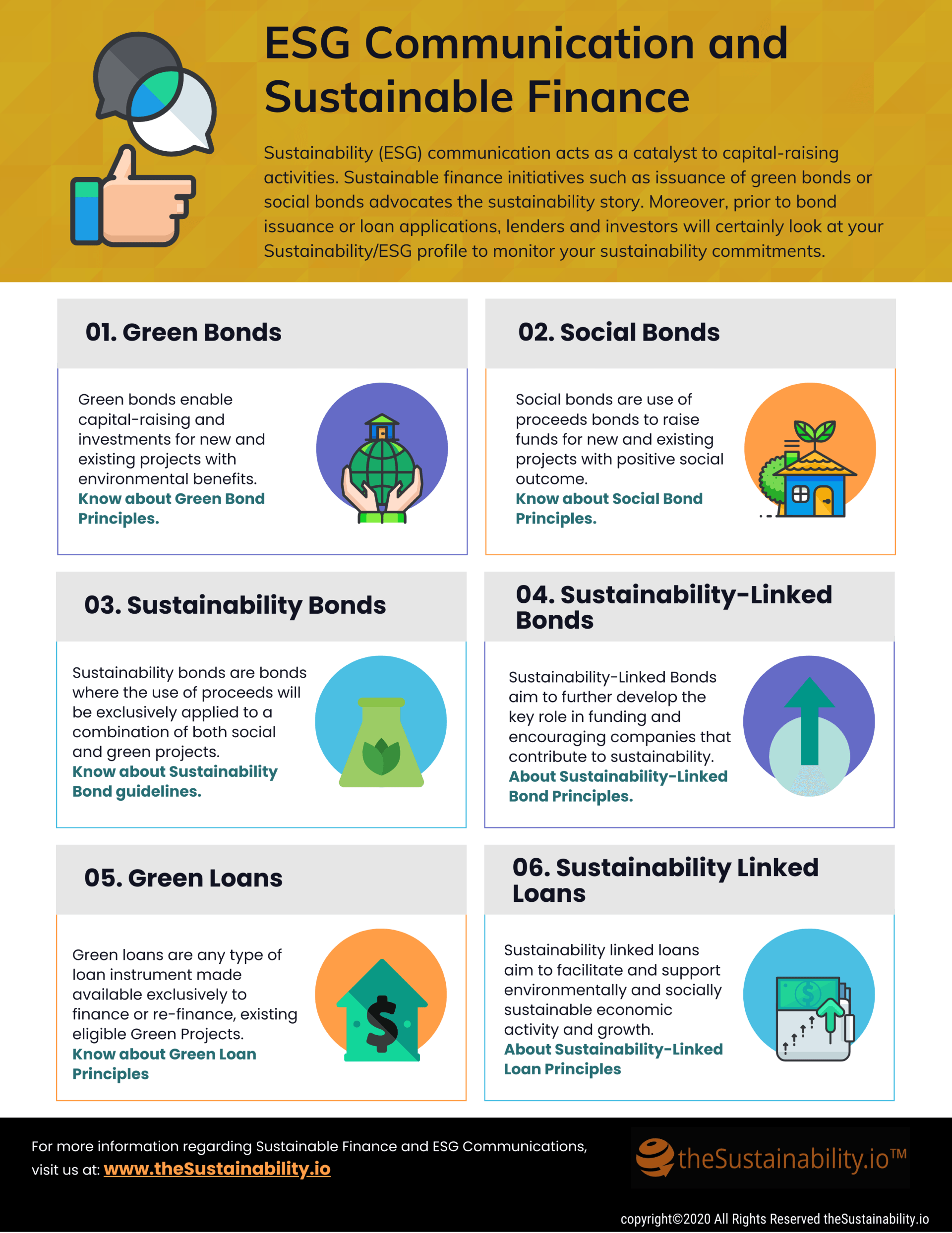

Sustainability (ESG) Communication and Sustainable Finance

MACK BHATIA

Sustainability (ESG) communication acts as a catalyst to capital raising activities when companies look for options among the sustainable finance instruments.

The established links between corporate sustainable strategies and increasing financial returns has resulted in a growing number of investors now considering environmental, social and governance (ESG) factors in their investment decisions.

As a result, investors and analysts are now searching for authentic ESG communication material on corporate digital communication platforms and others. But despite this fast-growing interest, most companies are lagging behind in terms of innovation and creativity when it comes to conveying authentic sustainability messages to the broader investment community.

As the article at HBR.org states,

“Larry Frank isn’t going to read your sustainability report”, companies will need to communicate very differently with their investors. Disclosing their performance on the most material environmental or social issues (determined by the Sustainability Accounting Standards Board) as Fink recommends, is a necessary step.

Sustainability Communication as a catalyst to Sustainable Finance

Sustainability (ESG) communication acts as a catalyst to capital raising activities when companies look for options in the financial markets.

Sustainable finance doesn’t have a definition by itself. Although, as our team puts it – it can be referred as ‘financial instruments and support available in the market specifically catered to provide capital to projects with environmental or social benefits”. Sustainable finance ecosystem is also supported by organizations such as

International Capital Market Association (ICMA) and Loan Market Association (or LMA). These organizations provide guidelines to structure your process to the expectations of market and lenders.

The purpose of green financing, as stated by the UN Environment Programme, is to increase the level of financial flows (from banking, micro-credit, insurance and investment) from the public, private and not-for-profit sectors to sustainable development priorities. The aim is to align financial systems, working with countries, financial regulators and financial sectors, to direct capital allocation to sustainable development that will shape the production and consumption patterns of tomorrow. Financial mechanisms such as Green Bonds help this alignment as they promote public-private partnerships for sustainable development.

Growing pressure across financial markets to consider environmental impact and risk as a major plank in investment decisions helped push fixed income instruments such as green and sustainable bond issues to record-breaking levels. Investors hedge against climate risk by investing in green bonds or social bonds and into companies which are serious about their sustainability progress.

Sustainability communication plays a very important role. Sustainable finance initiatives such as issuance of green bonds or social bonds advocates the sustainability story. It is an encouraging sign to investors that the company issuing bonds is serious about their sustainability progress. These initiatives, as we recommend and under regulatory framework should be added to the sustainability (or ESG) communication channels. Moreover, prior to bond issuances or loan applications lenders and investors certainly look at a company’s Sustainability/ESG profile to monitor your sustainability commitments.

ESG Communication can lower the cost of capital

One of the fixed income instruments that a company’s sustainability strategy can leverage is popularly known as ESG Linked Loan or Sustainability-Linked Loan. The interest rates on these types of loans is tied on the company’s ESG performance. This means, the better a company performs on its ESG parameters the lower the interest rate. Similarly, issuers can also leverage Sustainability-Linked Bonds where the financial or structural characteristics can vary depending on whether the issuer achieves pre-defined Sustainability / ESG objectives.

Connect with us to know more about how can we generate business value through Sustainability/ESG communication initiatives.

Reach out to us

Private equity firms are required to have an ESG strategy which is aligned to the limited partner’s ESG focus. Private equity industry is under greater scrutiny than ever before, and PE firms must do a better job of capturing and tracking the value they are creating and the impact of their activities.

SIOChain - Supply chain sustainability management system positions you stronger growth working closely with suppliers or partners to manage your environmental and social impact. Through supplier engagement, supplier recognition, and sustainable procurement, you can manage risks while increasing productivity and efficiency within the value chain

Our team provides services and due diligence to not only identify ESG opportunities but help our clients quantify potential ESG benefits and risks, incorporate ESG policies into the strategies and activities, facilitate transactions between asset buyers and sellers, and provide confidence among all parties that ESG commitments are made, and risks are managed.

It is very important that companies make sustainability and ESG a central component of their business model. “We know that climate risk is investment risk. But we also believe the climate transition presents a historic investment opportunity”, says Lary Fink from BlackRock. Authoritative statements like these present an opportunity for companies to prepare their business and our economy against the greatest global threats while it opens doors for capital access.

It is imperative to activate ESG and sustainability through the supply chain to develop transparency and visibility on ESG and sustainability practices. Companies need to collaborate with their suppliers and supply chain participants in upstream and downstream operations in order to meet their environmental and sustainability commitments. See more.

Effective communication with sustainable investors focused on your ESG progress is an important component of your ESG strategy. It fills the gap between investor expectations and your sustainability

or ESG strategy.Sustainability and ESG communication is an approach to engage your customers and

investors, and to showcase your ESG progress and sustainability commitments.

It is imperative to focus on supply chain sustainability in order to meet your sustainability commitments and meet your environmental targets. SIOChain™, a technology platform is designed to engage your suppliers and collaborate to measure, monitor and embed sustainability and ESG in your supply chain.

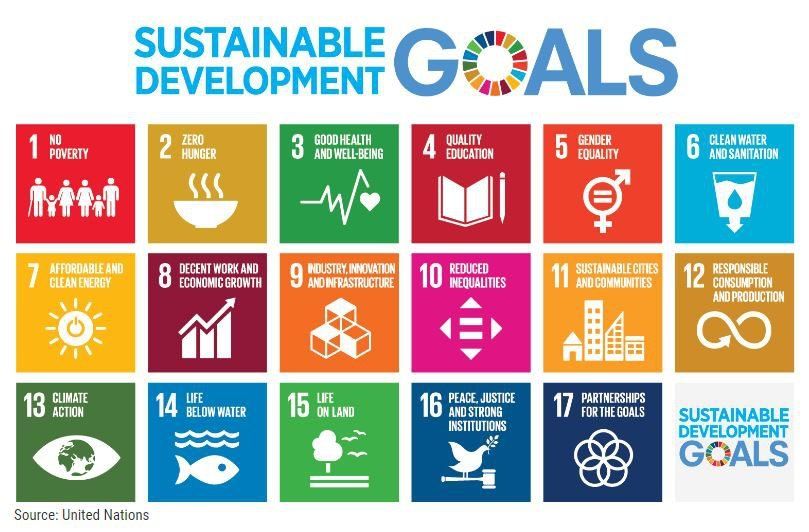

The purpose of sustainable financing, as stated by the UN Environment Programme , is to increase the level of financial flows (from banking, micro-credit, insurance and investment) from the public, private and not-for-profit sectors to sustainable development priorities. The aim is to align financial systems, working with countries, financial regulators and financial sectors, and direct capital allocation to sustainable development that will shape the production and consumption patterns of tomorrow. Financial mechanisms such as Green Bonds, Social Bonds and ESG Linked Loans help this alignment as they promote public-private partnerships for sustainable development. The Sustainable Development Goals (SDGs) are a collection of 17 global goals set by the United Nations General Assembly as an agenda for the year 2030. These 17 SDGs are an urgent call for action by developing and developed countries and provide a blueprint for the peace and prosperity for people and the planet. The SDGs also recognize issues related to the planet, such as biodiversity, and to people, such as poverty, and accept that solutions to address all of these issues are interconnected. Green Finance (or Sustainable Finance) instruments such as Green Bonds, and bonds focused on other thematic issues such as Social Bonds, Sustainability Bonds or Sustainable Development Goal Bonds, can act as a strong bridge to the SDGs. Such initiatives allow the flow of capital to execute and meet corporate sustainability commitments. They are also attractive to institutional investors as they perceive financial commitments to sustainability as a good indicator of a corporation's ESG progress. Related: More about Social Bonds