Why do you need a sustainable supply chain?

Why even bother to build a sustainable supply chain ? The answer to this question lies deep in the sustainability ecosystem largely driven by players including United Nations, Governments, Institutional investors and major corporations who realize that focusing on sustainability and Environmental, Social and Governance ( ESG ) improvements - beyond massive environmental benefits, results in operational cost reduction, better risk management and improved revenues. Following this, other companies and organizations realized the benefits and started to build their business models around sustainability.

These companies and corporations were soon required to prove that their environmental efforts are genuine and hence task forces (such as TCFD), reporting initiatives and disclosures, and accounting principles (such as Sustainable Accounting Standards Board or SASB) became the reference points for operational and strategic sustainable activities.

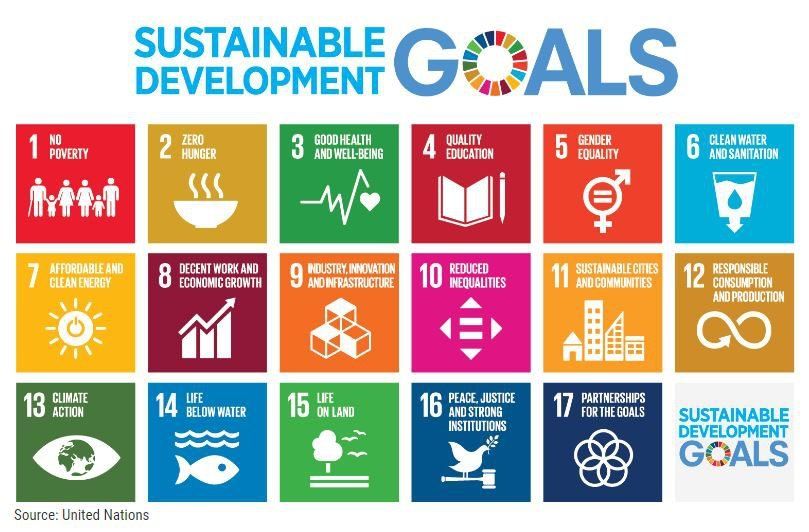

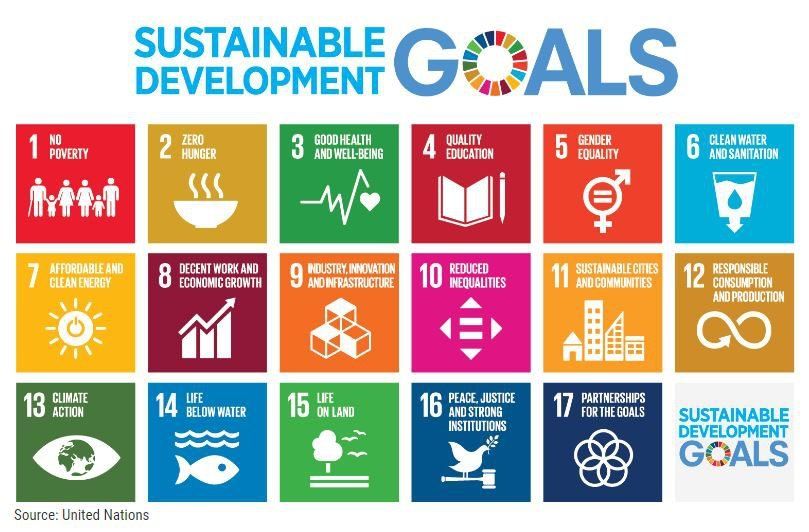

It became imperative that companies and corporations follow a structured approach with defined sustainability goals and sustainability commitments by 2030 or 2050 in alignment with Sustainable Development Goals well-defined by United Nations. These commitments are taken seriously by investors, governments, organizations and customers – all of which are very much responsible for both the top-line and the bottom-line numbers. And hence, reflecting on a shareholder value.

Many MNCs and other companies soon realized that it is impossible to meet these commitments unless they have visibility in their supply chain or measure environmental parameters such as use of plastic, carbon emissions and more. This is because most of the environment specific actions and operational activities reside in the supply chain operations. And therefore, it is utmost important to collaborate and engage with all supply chain participants and align them to environmental or social standards as defined by the respective sustainability commitments. This is an opportunity as such companies and corporations will be able to optimize their operations, reduce costs, able to manage risks a better way and can get compliance to regulations in the areas of their operations. But this is also a challenge.

How you can enable a sustainable supply chain

A recent Harvard Business Review report titled ‘A more sustainable supply chain’, mentions that Companies tend to focus on their top-tier suppliers, but the real risks come lower down. It also mentions that MNCs were fore fronted with embarrassed scrutiny when they realised that, that despite their commitment and suppliers said adherence, many supply chain participants violated the sustainability standards. This was just the start at the first-tier level, and that MNCs were certain that similar scandals might have occurred at the second-tier level and so on.

Part of the above, we believe that MNCs and similar companies also lagged strict re-enforcements of sustainability standards partly because of the needs of the business and partly because of the regular push to deliver more in a short duration of the time – to meet the demands.

We at theSustainability.io have been focused on this problem for a number of years. Our technology team with a deep expertise with sustainability realized this issue a way back, researched and developed a very effective platform, SIOChain™.

The platform solves the identified problems by enabling a smooth chain of collaboration among the company, first tier suppliers, second tier suppliers and so on. This is with a minimal effort as the system takes care of the above once a process is triggered. The sustainable supply chain system SIOChain™, also informs all participants on the sustainability standards, parameters to be measured. Failure or compliance to the adherence results in warnings or incentives for the suppliers and other supply chain participants.

The most important features of SIOChain™ are that companies and corporations can measure their sustainability goals such as carbon emissions, use of plastics, waste from produce etc, through their supply chain. This encourages ESG transparency which is very encouraging to institutional investors and customers.

Know more about SIOChain™ and feel free to connect with us if you have any questions.

1, Rockefeller Plaza, New York City, NY, United States, 10020 I 1-888-502-6838 | team@thesustainability.io

copyright © 2018 - 2022 theSustainability.io, All rights reserved