Sustainable Development Goals and Green Financing

MACK BHATIA

Leverage Sustainable Development Goals, Finance your Sustainability strategy

The purpose of sustainable financing,

as stated by the UN Environment Programme, is to increase the level of financial flows (from banking, micro-credit, insurance and investment) from the public, private and not-for-profit sectors to sustainable development priorities. The aim is to align financial systems, working with countries, financial regulators and financial sectors, and direct capital allocation to sustainable development that will shape the production and consumption patterns of tomorrow. Financial mechanisms such as Green Bonds, Social Bonds and ESG Linked Loans help this alignment as they promote public-private partnerships for sustainable development.

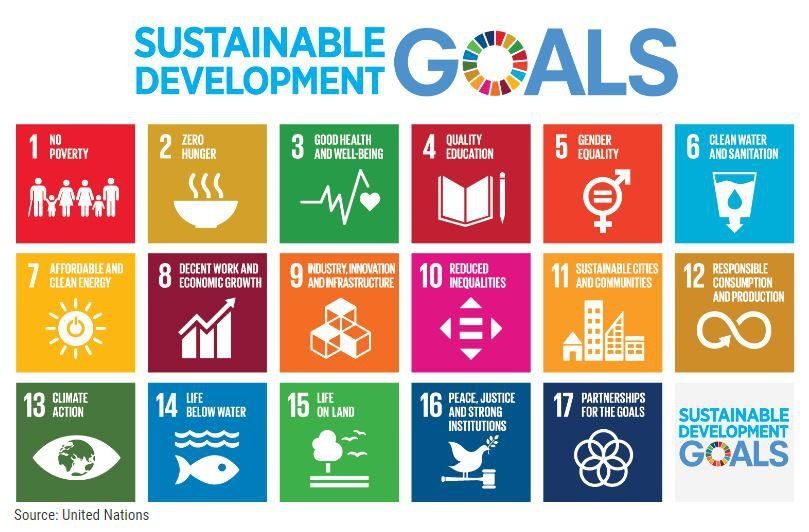

The Sustainable Development Goals (SDGs) are a collection of 17 global goals set by the United Nations General Assembly as an agenda for the year 2030.

These 17 SDGs

are an urgent call for action by developing and developed countries and provide a blueprint for the peace and prosperity for people and the planet. The SDGs also recognize issues related to the planet, such as biodiversity, and to people, such as poverty, and accept that solutions to address all of these issues are interconnected.

Green Finance (or Sustainable Finance) instruments such as Green Bonds, and bonds focused on other thematic issues such as Social Bonds, Sustainability Bonds or Sustainable Development Goal Bonds, can act as a strong bridge to the SDGs. Such initiatives allow the flow of capital to execute and meet corporate sustainability commitments. They are also attractive to institutional investors as they perceive financial commitments to sustainability as a good indicator of a corporation's ESG progress.

How are Sustainable Development Goals relevant to Corporate finance?

Each of the 17 goals comes with its respective set of targets and with the corresponding indicators to measure the progress against those targets.

Corporate finance when aligned with the corporate sustainability strategy often finds it a challenge to find and allocate capital to fund sustainability commitments. This is when they can look towards a suite of Sustainable finance instruments such as Green Bonds, Social Bonds, Sustainability Bonds or Sustainability-Linked Bonds commonly referred to as ESG Linked Bonds. The finance teams can also look at loan instruments such as Green loans to meet their financial needs.

Related : Sustainability Communication and Sustainable Finance Instruments

When issuers decide to issue a Green Bond or a Social Bond, the project framework must be built around the Green Bond Principles, Social Bond Principles or Sustainability Bond Guidelines. These principles and guidelines, developed by International Capital Market Association (ICMA), encourage issuer transparency and disclosure of the project's details including how the proceeds are intended to be used (use of proceeds), and the reporting process. As per the principles, the annual report should include the list and description of allocated projects and their expected impact.

While developing this framework, issuers can map the use of proceeds with the most relevant SDG. As a next step, issuers can then refer to the respective targets for the specific SDG to measure and report on the impact of their projects. Corporations and companies should ensure that the use of proceeds are aligned with the overarching sustainability commitments or with the ESG integration strategy.

Although climate action underpins the some of the SDGs (SDG 13) and is a crosscutting theme, issuers have an opportunity to also earmark the use of proceeds to other categories such as Socioeconomic Advancement and Empowerment (SDG 1), Terrestrial and Aquatic Biodiversity Conservation (SDG 14 and SDG 15), Affordable Basic Infrastructure (SDG 3), or Climate Change Adaption (SDG 13).

The spreadsheet supplement (download)

created by ICMA includes a more detailed listings of SDG targets mapped to the Green Bond Principles and Social Bond Principles.

For reference,

this High-Level Mapping to the Sustainable Development Goals

developed by ICMA aims to provide a broad frame of reference by which issuers, investors and bond market participants can evaluate the financing objectives of a given Green, Social or Sustainability Bond/Bond or a loan programme against the Sustainable Development Goals (SDGs).

The rapidly growing green finance sphere is already providing capital for assets that simultaneously contribute to climate action and many of the other SDGs. Corporations, when aligned with SDGs, have an opportunity to make a positive impact through sustainable development.

Learn more about Sustainable Finance Services.

These should be communicated well to investors and customers for material benefits.

Reach out to us

Private equity firms are required to have an ESG strategy which is aligned to the limited partner’s ESG focus. Private equity industry is under greater scrutiny than ever before, and PE firms must do a better job of capturing and tracking the value they are creating and the impact of their activities.

SIOChain - Supply chain sustainability management system positions you stronger growth working closely with suppliers or partners to manage your environmental and social impact. Through supplier engagement, supplier recognition, and sustainable procurement, you can manage risks while increasing productivity and efficiency within the value chain

Our team provides services and due diligence to not only identify ESG opportunities but help our clients quantify potential ESG benefits and risks, incorporate ESG policies into the strategies and activities, facilitate transactions between asset buyers and sellers, and provide confidence among all parties that ESG commitments are made, and risks are managed.

It is very important that companies make sustainability and ESG a central component of their business model. “We know that climate risk is investment risk. But we also believe the climate transition presents a historic investment opportunity”, says Lary Fink from BlackRock. Authoritative statements like these present an opportunity for companies to prepare their business and our economy against the greatest global threats while it opens doors for capital access.

It is imperative to activate ESG and sustainability through the supply chain to develop transparency and visibility on ESG and sustainability practices. Companies need to collaborate with their suppliers and supply chain participants in upstream and downstream operations in order to meet their environmental and sustainability commitments. See more.

Effective communication with sustainable investors focused on your ESG progress is an important component of your ESG strategy. It fills the gap between investor expectations and your sustainability

or ESG strategy.Sustainability and ESG communication is an approach to engage your customers and

investors, and to showcase your ESG progress and sustainability commitments.

It is imperative to focus on supply chain sustainability in order to meet your sustainability commitments and meet your environmental targets. SIOChain™, a technology platform is designed to engage your suppliers and collaborate to measure, monitor and embed sustainability and ESG in your supply chain.